Unpacking the Panama Canal - A Geopolitical Chess Match

- Liz Priestman

- Jan 23

- 3 min read

Updated: Apr 18

Have you ever had one of those conversations that feels like you’re peeling back the layers of a political thriller, only to realize it’s actually today’s headline news? That’s exactly how I’d describe my latest interview with Nicholaus for The Ripple Effect the morning after President Trump’s inauguration. This time, we tackled the Panama Canal—yes, the Panama Canal, that iconic artery of global trade and, as it turns out, a geopolitical powder keg waiting to ignite.

Trump’s Bold Moves

It all started with the newly inaugurated President Trump, who, in true Trump fashion, wasted no time shaking up the global stage. His renewed ambition to reclaim the Panama Canal and rebrand it as the “Gulf of Mexico” (because why not?) has raised more than a few eyebrows. Naturally, Nicholaus and I had to dig into this. What are the stakes? Why now? And, most importantly, what does this mean for trade, defense, and the delicate balance of power between the U.S. and China?

Why the Panama Canal Matters

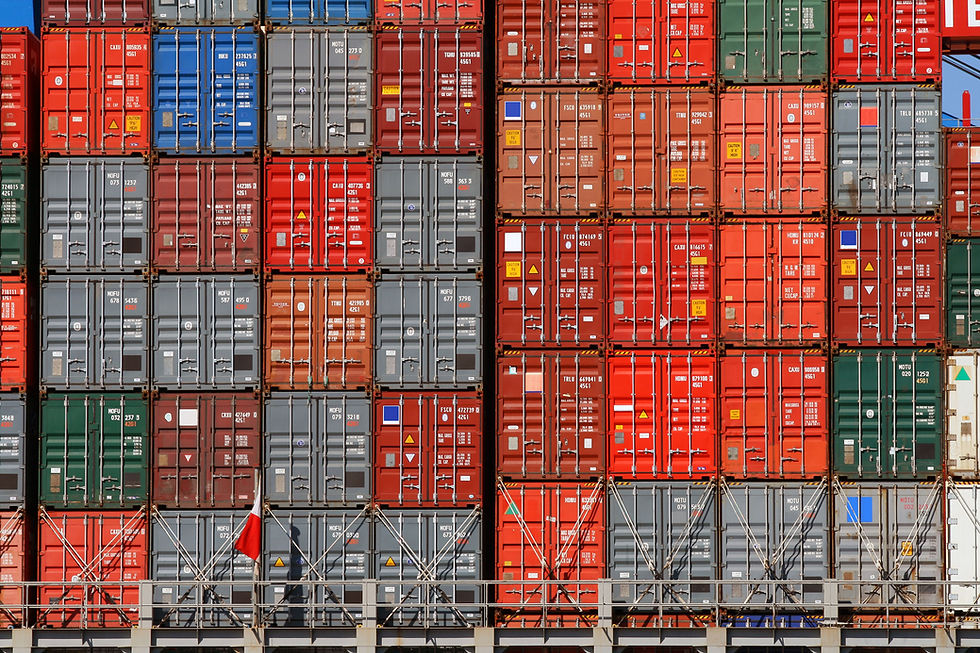

During the conversation, I highlighted a striking fact: approximately 6% of global maritime trade passes through the Panama Canal each year. It’s a vital link between the Atlantic and Pacific Oceans, cementing its place as one of the world’s most critical chokepoints for commerce.

The Canal’s Complex History

Nicholaus, ever the oracle of global affairs, then took us deeper into the history of the canal and its modern-day dynamics. He traced the canal’s journey from its construction by the U.S. in 1914 to its handover to Panama in 1999, a transfer that came with a treaty guaranteeing its neutrality. But where things get really interesting is the management of the canal’s entry ports. Nicholaus explained that these ports are operated—not owned—by Hutchison Ports, a subsidiary of Hong Kong-based CK Hutchison Holdings, controlled by the family of Li Ka-shing. It’s a small but significant distinction, and one that has become a flashpoint in the broader narrative of Chinese influence in critical infrastructure worldwide.

A Geopolitical Chess Match

President Trump’s rhetoric has zeroed in on the role of Hutchison Ports and its potential ties to Beijing. Nicholaus laid out how this Hong Kong-based conglomerate’s operations have drawn scrutiny, given China’s increasing control over strategic assets globally. Combine that with heightened U.S.-China tensions, and you have all the makings of a geopolitical chess match, with the Panama Canal as the board.

Caught in the Crossfire

But here’s the kicker: the canal isn’t just about trade routes or military posturing. It’s a symbol of something larger—a global tug-of-war over influence, resources, and economic partnerships. Nicholaus pointed out how countries like Brazil and Chile, rich in agricultural commodities and critical minerals, are caught in the middle. They depend on the canal for exports but are also navigating the complicated dynamics of U.S. security guarantees and Chinese foreign investment.

The Ripple Effect

By the end of our chat, my head was spinning—in the best way. Nicholaus has a way of taking what seems like a niche issue and showing how it connects to the bigger picture. Trade disputes, security dilemmas, even the future of Latin America’s economic development—they’re all tied to this 50-mile stretch of waterway.

So, what’s the takeaway? The world is watching. The Panama Canal may be just one line item in Trump’s agenda, but its implications stretch far and wide. Whether it’s about rerouting trade, rethinking alliances, or recalibrating power, this story is just getting started.

Tune in to watch the full episode of The Ripple Effect. And trust me, you’ll want to hear Nicholaus’ insights firsthand. If nothing else, you’ll walk away with a deeper appreciation for how a simple canal can shape the fate of nations—and a few more geopolitical factoids to impress your friends at your next dinner party.

Update: April, 18 2024 BlackRock’s high-profile $22.8 billion deal to acquire 43 global ports from Hong Kong-based CK Hutchison, including two near the Panama Canal, has not yet closed. While the broader transaction is moving forward, the Panama portion is facing delays due to mounting regulatory and geopolitical scrutiny. Chinese antitrust authorities are investigating the agreement, and Panama’s Maritime Authority has requested additional legal and financial disclosures. These pressures reflect the broader ripple effects of strategic infrastructure control, where global trade routes, national security interests, and economic influence intersect, reinforcing that ports are more than just points on a map.

Comentários